State funding, local taxes, school bonds…how does it all add up to fund Palo Alto schools? Palo Alto is unique in so many ways, including how our public schools are funded. Read on to find out where the money comes from and where it goes in Palo Alto schools.

How much does Palo Alto spend per student per year?

Palo Alto Unified School District (PAUSD) has an annual budget of about $270 million, and per pupil spending of about $16,000. Across California, the average per pupil spending is about $10,000, which places the Golden State near the bottom in terms of state rankings for per pupil spending. Despite having a strong tax base, PAUSD remains just slightly above the national average for per-student funding and behind many other high-performing districts, which spend about $20,000 per student.

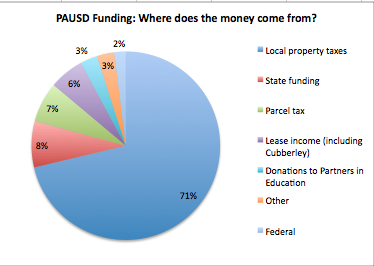

Where does the money come from?

Almost 90% of the revenue for Palo Alto Unified School District (PAUSD) is generated through local sources, including property taxes and the parcel tax because it is a ‘basic aid’ district. Palo Alto is one of the most locally funded districts in the state.

What does ‘basic aid’ mean for Palo Alto?

Palo Alto funds our schools largely through local revenue because PAUSD is one of only about 10% of districts across the state that are what’s called “basic aid.” This means that Palo Alto brings in more money from our local property taxes than we would get from Sacramento. Other local basic aid districts include Mill Valley, Woodside and Los Altos.

As a basic aid district, Palo Alto’s revenue is not tied to the number of students in our schools. As a result, if PAUSD adds students but our property taxes do not grow, the amount available per pupil declines. Of course the opposite is true too- if property taxes increase and enrollment is flat or declining, there is more funding to spend per student.

PAUSD has added an additional 2,000 students in the past 10 years, and due to our basic aid structure, these new children do not automatically mean an increase in funding.

Why does the parcel tax matter?

The parcel tax in Palo Alto for the current year $758 per assessed property, regardless of property value. Seniors can apply for an exemption from the parcel tax.

The Palo Alto parcel tax generates 7% of PAUSD’s operating budget, which is almost the same as state funding. Revenues from the parcel tax are essential for PAUSD because they are not dynamic to the economy (unlike property taxes) and form a locally controlled stream of reliable funding dedicated only to educating the children of Palo Alto.

The current parcel tax was last renewed in 2015. As a sign of the community’s commitment to public education, the last parcel tax renewal in 2015 was approved by almost 80% of Palo Alto voters.

What is Partners in Education (PiE)?

Partners in Education (PiE) is the only nonprofit organization dedicated to raising funds to support all of PAUSD schools and students. PiE relies on a team of over 200 parent volunteers to raise funds at each school site, which are then distributed back to Palo Alto schools on a per pupil basis to ensure equitable distribution of resources across the district.

Since PiE was founded in 2005, the organization has donated over $30 million to PAUSD schools. In 2017, PiE donated a total of $5.8 million dollars to PAUSD.

PiE asks Palo Alto families to give $1,000 per child enrolled in PAUSD, which is lower than many surrounding communities such as Woodside, where parents are asked to give $4,800 per child.

School principals control how PiE funds are spent, using guidance from district leadership and in response to their specific student needs. PiE funds can only be used to pay for salaries, not for materials or supplies. In 2013-14 school year, PiE funded salaries for 250 full and part time instructors, teachers and counselors in PAUSD schools.

In PAUSD elementary schools, PiE funds classroom aides, along with art, science and music programs. In middle schools, PiE pays for elective teachers, counselors and classroom specialists, and in high school, PiE supports college counseling, STEM-based electives and other school-based programs to engage students and support their academic growth.

What’s the deal with Cubberley?

As seen in the chart above, lease revenue generates 6% of PAUSD’s operating budget. Of this, $7 million has been coming from the fee the City of Palo Alto pays PAUSD to lease Cubberley for recreation facilities and space for numerous city programs and nonprofits. With the new Cubberly agreement that was framed in November 2014, PAUSD will lose almost $2 million a year in these fees. There is no immediate new income stream to replace this revenue loss. The City of Palo Alto is currently working with Palo Alto Unified on a new vision and plan for how to use the Cubberley building complex.

Why aren’t bond funds included in the chart?

Bond funding is a separate income stream for facilities only. In 2008, 77% of voters passed the Strong Schools Bond, a $378 million bond to upgrade and build facilities for Palo Alto’s aging schools and growing student population. The Strong Schools Bond has funded many major facility projects at our Palo Alto schools, including the new buildings at Gunn and Paly high schools. Measure Z, which would raise new funding for school facilities in Palo Alto, is on the November 2018 ballot.

Bond measures require a simple majority (55%) to pass and are repaid through property taxes. Bond funds are not included in the revenue chart because they cannot be used for operational costs, except for purchasing technology.

If PAUSD were to open additional schools, a new bond could be necessary to pay for the construction and rebuilding costs.

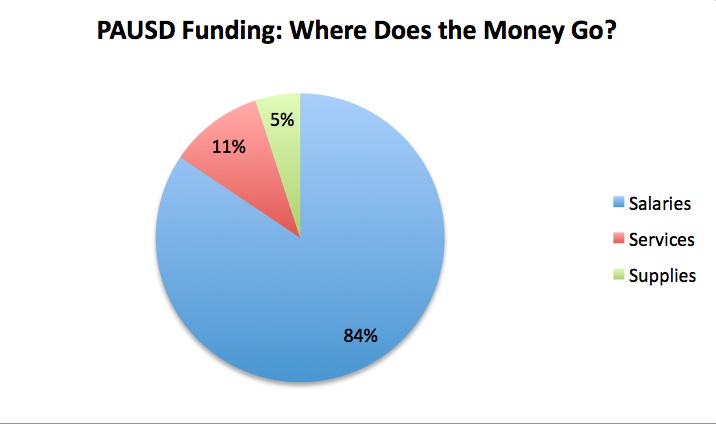

Where does the money go?

Like most organizations, PAUSD’s biggest expense is its people. The majority of the district’s budget is spent on salaries and benefits for teachers, administrators and support staff.

PAUSD has won the Meritorious Budget Award from the Association of School Business Officials International (ASBO) and has a conservative approach to spending its revenue.

Palo Alto maintains large reserve, part of which is required by the basic aid reserve policy. Much of the revenue that Palo Alto Unified brings in each year is allocated by law and contract to specific expenses and only a tiny portion of the $220 million budet is currently ‘unrestricted,’ which means it has flexibility to address the changing needs of PAUSD students. This is why the almost $6 million raised by PiE is so valuable for Palo Alto school principals.

What’s the bottom line?

Palo Alto’s excellent public schools rely almost entirely on local funds. Funding from the state is minimal for Palo Alto and federal funding is even lower. While Palo Alto’s property taxes revenues have been on the rise in recent years, so are expenses for PAUSD, particularly salaries and benefits. Governor Brown is also shifting responsibilities for unfunded pensions to local districts and Palo Alto will be required to foot a lion’s share of this bill.

We are extremely fortunate in Palo Alto to have a strong property tax base, supportive families and a community that values public schools. However local funding, including the parcel tax, PiE and bond funds are more important then ever for ensuring a strong future for Palo Alto public schools.

Resources:

Palo Alto Unified audit report, June 2017, Chavand & Associates, LLP.

For more information on how money works, check out the Palo Alto Pulse overview of city finances: Where does the money come from and where does it go in Palo Alto?

Sign up here to follow Palo Alto Pulse and stay tuned about all things Palo Alto

A fascinating and most informative article…

This is the clearest article I’ve found detailing how PA schools are funded. Thanks! I’ve used it several times to answer or clarify questions from others.